Podcast: Play in new window | Download (Duration: 48:26 — 66.5MB)

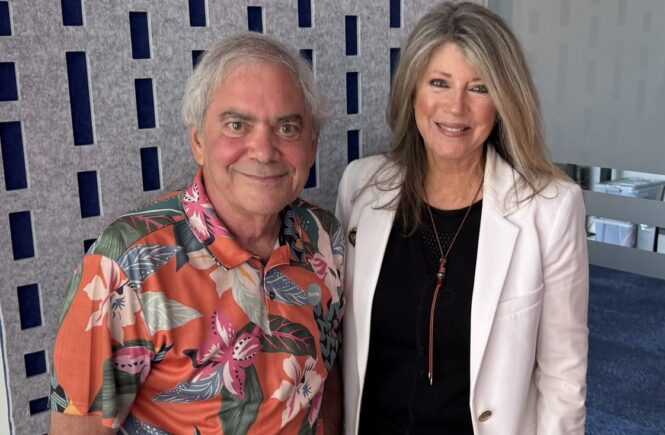

Real estate expert Bill Bacque of Market Scope Consulting, whose career has spanned over 53 years in the housing industry, joins Discover Lafayette to discuss real estate trends.

Formerly with Van Eaton & Romero—later acquired by Latter & Blum—Bill is now retired, but his passion for tracking housing statistics and analyzing market trends remains strong. In this episode, Bill shares a data-rich, thoughtful overview of how the housing market in Lafayette has evolved and what lies ahead.

“If you look at average sales price over the last 50 years, the overall trend has been up,” Bill began. “That being said, there have been periods… where sales and average prices actually drifted downward. But values were always recouped.”

Bill dug into what he called the “Covid years,” pointing out the extraordinary surge in home sales from 2018 to 2021. “In Lafayette Parish, we went from 3,380 transactions in 2018 to 4,830 in 2021—a 43% increase.” Much of this, he explained, was driven by families realizing during the lockdown that they needed more space, “after six months of living together with your wife and three children, working out of your house, eating at your house, living in your house. People began to say, I need a bigger place. Maybe double the size.” And this phenomenon was coupled with historically low interest rates. “By January of 2021, the interest rate was 2.65%.”

But as quickly as the boom came, it corrected. From 2021 to 2024, Lafayette experienced a 34% drop in sales. “We literally gave it all back,” Bill said. “Sales are back to 2018 levels. Statistics through May of 2025 show that we are about equal to where we were in May of 2018.”

Bill broke down the dramatic rise in average sales prices during COVID, noting that from 2018 to 2022, the average price of a home rose from $223,500 to $285,000, a $50,000 increase in the average cost of a home in four years. However, from 2022 to 2025, the average price has only nudged upward 2.6%, reaching $292,200. “So the average sales price is beginning to stabilize.”

He further explained the numbers shared: “I would put some clarification that the average sales price takes into consideration the upper income properties as well as the lower ones. This average sales price includes new construction sales and existing sales. If you back out the new construction sales, the average sales price in Lafayette Parish is about $275,000.00.”

One big issue affecting today’s buyers? Affordability. “There’s been a significant erosion,” Bill noted, citing both rising home prices and higher interest rates. He shared that the average age for a first-time homebuyer in the U.S. is now 38 to 39 years old—compared to 22 when he bought his first home for under $10,000 in Lake Charles.

“What we’re seeing on a national standard basis is that the average age now for a first time buyer is 38 to 39 years old. When I bought my first house in 1973, I was 22 years old. That was the thing that happened then. I can’t remember what the first house cost, but it was less than $10,000. It was a little bitty house. It was about the size of an apartment.“

Homeowners insurance is now a major wildcard. “My son found a home under $300,000, qualified, but the deal fell through because insurance added another $500 a month,” Bill shared. This isn’t a unique story—buyers across South Louisiana are finding it harder to afford not just a mortgage but the added costs of ownership.

We also talked about the evolving design of homes. Post-Covid, people want dedicated workspaces, and Bill said square footage is being used more efficiently. Yet affordability challenges persist. “In 2018, homes under $150,000 made up 24% of our sales. Today, it’s 12.3%,” he said. Meanwhile, homes over $300,000 have grown from 16% of sales to 31%.

Another key point Bill raised: “The companies are not the brand anymore. The agents are the brand.” Technology has reshaped the real estate profession, and today’s top producers build their own personal brand—something Bill said wasn’t possible back when listings came via mimeographed sheets once a week.

Bill also addressed the shortage of available homes, particularly in affordable price points. “There are currently 69 homes listed at $1 million or more in Lafayette Parish. But only 12 have sold so far this year. At that rate, we have a 28- to 29-month supply.” In contrast, homes under $150,000 are in high demand but low supply.

We also touched on long-term housing trends. Many Baby Boomers are choosing to “age in place,” creating tighter inventory. “We’ve always thought the ‘silver tsunami’ would flood the market with homes,” Bill said. “But they’re living longer, and they don’t want to move.”

And what advice does Bill give to people thinking about buying their first home today? “Well, probably don’t talk to me—I know too much,” he laughed. “Talk to someone like my son, Joel Bacque, who’s in the business today. He says, ‘If you want a home, we’ll find a way to get you in.’ It might not be your dream home, but it’ll be a start.”

As affordability challenges grow, Bill believes it’s time to revisit old assumptions. “What if we had 50-year mortgages?” he asked. “Just like we’ve extended auto loans to 72 months. Who lives in a house for 50 years anyway?”

Bill’s data-driven approach gives a clear picture of the local market—its cycles, its pressures, and its future. He leaves us with a reminder: “Real estate is first and foremost about satisfying a need. Yes, it’s an investment. But it’s primarily about having a place to live.”

Discover Lafayette thanks Bill Bacque for sharing his expertise, insights, and analysis. He is a true outlier in the real estate industry, someone who has dedicated his whole professional career to helping others while freely sharing his knowledge with all.