Podcast: Play in new window | Download (Duration: 1:03:10 — 86.8MB)

Lafayette Parish Tax Assessor Conrad Comeaux joins Discover Lafayette to explain how taxes are levied and collected. Who pays for what? How is your home’s value assessed? This all really hits home when you get that bill in the mail.

Serving as Tax Assessor since 2001, Conrad previously served on the Lafayette Parish Council from 1984 to 1996. A native of Scott, he graduated from USL, now UL-Lafayette, with degrees in biology and chemistry, and received a master’s degree in health administration from Tulane University.

He has been active in incorporating technology to help his office more efficiently serve the public, and was the first assessor in the state to put property values online and the first in Lafayette Parish to produce a digital map of ownership parcels.

He views the office as non-political and says “we are there to do a job.” While many people may think that the Tax Assessor sets tax millages and collects taxes, in fact, his office is only involved in determining the value of three things: land, buildings, and “extra features” that affect value (such as fencing, pools, and tennis courts). So when you receive your tax bills, they are coming from the Sheriff and local municipalities, not the Assessor.

Louisiana’s tax system differs from other states in the manner in which taxes are calculated. In most states the land and improvements are combined to reach a value; here, we separate out features of the property (i.e., the land is valued separately from the improvements) and taxed at different rates. Land and residential buildings are assessed at 10% of their market value; commercial buildings are assessed at 15% of market value.

In a similar vein of Louisiana being different, in other states, property taxes are typically the biggest generator of local revenue; here, it is sales taxes.

Millages collected throughout Lafayette Parish are very low compared to other parishes in Louisiana. In some years. Lafayette Parish millages are half of those collected in St. Tammany Parish. In fact, St. Tammany Parish school taxes are as high as what we are assessed for all Parish functions.

It can be challenging to assess residences in neighborhoods with a wide range of values, and he gave an example of how homes on the front end of Kim Drive vary greatly in value from those closer to the Vermilion River. Conrad’s office does “mass appraising,” meaning that they look at values within a subdivision, or streets within a subdivision, not each individual home. However, his office is provided with a copy of each Act of Cash Sale filed at the courthouse and they utilize the value listed on the sale as a frame of reference. If you disagree with the assessed value of your home, Conrad encourages you to call his office at (337)291-7080 to bring it to his attention. It will be adjusted if they find a mistake (such as an overestimation of total square footage).

Lafayette Parish Tax Assessor Conrad Comeaux will inform the councils of local governments on tax revenues and the implications of their decisions on their votes to maintain or raise millages. Their decisions can have a long-term impact on ensuring adequate levels of funding for mandated government services.

Reassessments are typically done every four years. The Assessor’s office will examine sales around a particular time frame to update values. As an example, for the 2020 reassessment, they looked at sales occurring six months before and six months after January 2019 to determine current values. With dramatic swings in market values, this process can cause people to scratch their heads wondering how a value was arrived at, but it’s important to remember that the assessment is based upon a value from a couple of years back. If your home is damaged by a fire or hurricane and its value is greatly affected, please contact the Assessor’s office to report the occurrence and the assessed value will be adjusted accordingly.

Once the reassessment is completed, the Assessor’s office determines the total assessed value of all properties in the parish. If it has declined overall, the local taxing authority is authorized to raise millages to bring in the same revenues as the previous year. This process is “an adjustment of the maximum” allowed by the Louisiana Constitution. On the other hand, if the total assessed value of all land in the parish has increased, all taxing bodies must lower millages to bring in the same revenue as the previous year. But state law then allows the body, by a 2/3 vote, to raise the millage to the prior year’s maximum, known as a “roll forward.” If the taxing body doesn’t vote to adjust the millages before the next reassessment period, the opportunity is lost to achieve the new maximum, which can lead to future deficits.

Inasmuch as property taxes are the most stable form of government funding, it is critical for each taxing body to not only look at the current tax revenue stream but to think ahead about future funding when times may not be as good and prices have risen due to inflation. Conrad reflected back on the first four years of consolidation when Lafayette’s millages weren’t rolled forward. This inaction from years ago has resulted in deficits over time, particularly for parish-mandated services such as maintaining the courthouse and jail, and adversely affects funding available for other needs.

For the first time since the 1980’s oil bust, commercial land and improvement values actually fell due to the COVID shutdown in 2020. Restaurants, hotels and oilfield service buildings all saw a tremendous decrease in value.

Parish millages dedicated to drainage, roads, and bridges are paid by all Lafayette Parish residents, yet, historically, the funds have primarily always gone to cover needs in the unincorporated areas of the parish. While residents of each city within the parish may bemoan this fact, Conrad explained that “water doesn’t stop at the outer limits of each city. We are all affected by conditions in the outlying areas and benefit from these services to some extent.

Assessed land values (10% of market value) in the parish have roughly doubled since Conrad took office in 2001. At that time, assessed land values were approximately $1.16 billion; today, they are assessed at $2.2 billion. In the City of Lafayette, assessed land values equaled $678 million; today, the value is $1.545 billion.

“Of all the things I’ve done while in office, the one vote I regret is to vote for consolidation. We used Baton Rouge as an example, which seemed to be going well at the time. Fast forward to now, look at what is happening to the City of Baton Rouge. Now you’ve got people moving out of Baton Rouge and trying to incorporate the City of St. George. And Central didn’t exist 20 years ago. Now, look at Lafayette. The City of Lafayette has historically been the engine driving this train…..but will the city itself be as vibrant as it once was? I don’t know because the city can’t grow as it should in order to be a vibrant city. If we lose that ability to grow, we’ll end up like Baton Rouge and East Baton Rouge Parish, which is a shame. We could fall by the wayside. But people say look what’s happening in Youngsville, Broussard, Scott, and Carencro! What’s happening is, it’s eroding what’s happening in Lafayette. The City of Lafayette no longer has its own mayor. It has its own council to an extent, but it’s not quite the same as being separate from the parish. Therein lies part of the problem of what’s going on here. How many art studios are in those other communities, how many performing art centers, or the cultural things that made Lafayette great. People don’t remember why Vermilionville was set up in the first place. People forget that investments in Vermilionville were made following the oil crunch in the 80s in order to diversify our economy. Studies show the longer you keep tourists in your town, the more they spend. If you remove those amenities, why would tourists want to come here? “

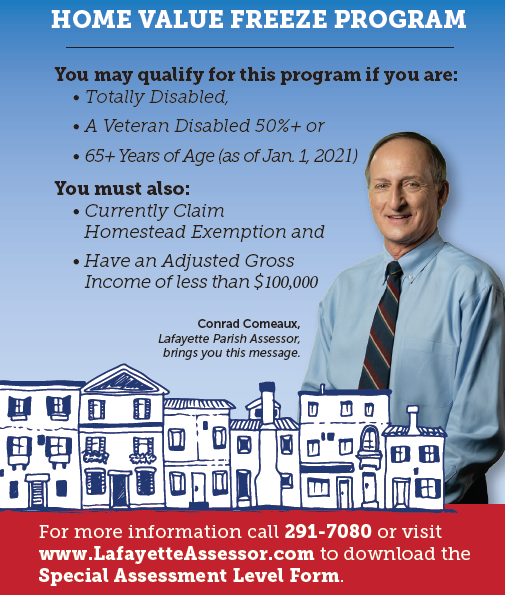

It pays to ask the Assessor for legal perks known as ‘abatements’ that are afforded to certain groups of people. One such program is the Senior Freeze, which is available to people 65 of years and older who have an adjusted gross income of $100,000 or less. Your property value is frozen as of the date you apply, which need only be filed once to last the rest of your life time. While your tax bill may change over time, the assessed value won’t. Similar benefits are available by law to injured veteran’s who must apply yearly for the freeze to operate.

There has been a troubling increase in tax sales lately, all of which is legal but regrettable. Out-of-town companies have been coming in and paying taxes on properties in which the legal owners have not kept up their payments. While Conrad’s office is not made aware of the sales until they receive notice of the recorded tax sales, he has seen a noticeable uptick in this process. Most of the people affected either don’t know how to fight the process or don’t have the financial wherewithal to fix the problem by paying the back taxes.

Don’t forget to file for your homestead exemption when purchasing a new home. You save about $640 annually on your tax bill by filing this simple piece of paper with the Assessor’s office and receiving a tax exemption on the first $75,000 of the value of your home.

For more information, visit https://www.lafayetteassessor.com/ or phone (337)291-7080.

Thank you, Conrad Comeaux, for your longstanding commitment to community service!