Podcast: Play in new window | Download (Duration: 26:34 — 27.2MB)

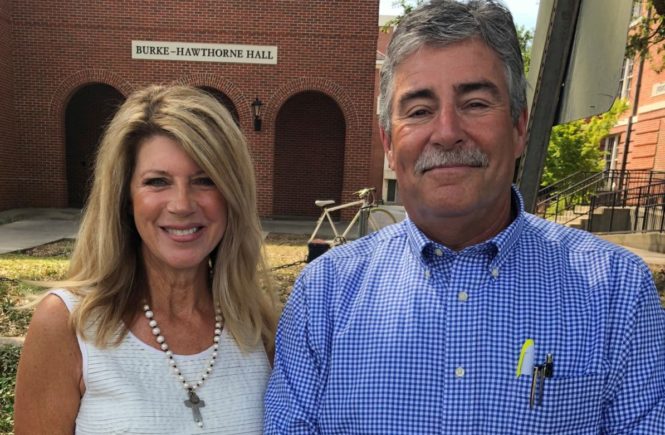

Marc Mouton of the Insurance Resource Group offers an experienced take on the many ways people can purchase insurance in a cost-effective way. With the price of insurance rising, along with the mandates of the Affordable Care Act, it is a challenge for businesses and individuals to stay afloat and keep their families covered.

While just a few years ago you could purchase health insurance for your family for approximately $400 – 600 per month, costs have risen dramatically. Marc cited a recent example of a 56-year-old man with a 55-year-old wife and three children, who needed an individual plan. For a policy with a $4,500 deductible, no co-pay for doctor visits, and no prescription drug plan….which is basically a barebone catastrophic plan, the quote was $2,265 per month. Marc explained that if the couple formed an LLC (limited liability company), naming themselves as the managers, they could qualify as a legal entity and then obtain the same health insurance for $1,400 per month. People are taking steps to afford health insurance in ways that were unheard of just 3 to 4 years ago as the cost of health insurance is creating an economic depression within the middle classes.

Paying cash for medical procedures also opens up the opportunity to save money. This interview is eye-opening for those of us who are independent contractors caught up in the conundrum of covering our healthcare expenses. Consumers are poor negotiators when it comes to healthcare. We’ll haggle over the cost of a car or a mobile device at Best Buy, but not for our own health procedures.

Special thanks to James Hebert of KRVS for taping this interview. We’re grateful for their support.